Lesson: We went back to renting.

Whew. My last post on this blog was in January of this year. My husband and I have been so busy fixing the mistake of buying a condo that we’ve only been able to slow down A BIT today. This had been weighing on our minds since 2019, actually. DAY 1: Finding out upon key turnover (after the purchase contract had been signed) that the rules for pets have changed.

When the pandemic happened, the causes for unhappiness and instability just piled up. I’ve blogged about this before. (See: Before Buying Property) But the turning point was when our senior cat, Kirara, started getting sick more frequently and she needed to be taken to the vet. There we were: without our car (sold due to lack of parking) and at the mercy of public transportation. In the middle of a pandemic. Then my immediate family all tested positive for COVID-19. To top it off, hubby and I also weren’t sure if we’d still have our jobs as the pandemic continues to ravage our economy. Gosh. All these were enough to make us rethink about our life decisions.

Sooooo we spent the first quarter of 2021 preparing to leave. Last week, we had finalized the papers for letting go of the condo. We never expected that we’d be able to get our 1.1M back, so we’re chalking that up to sunk costs. We have to. If we had gone on to get a loan in 2022, we would have sunken into a deeper quagmire.

We moved to a rented house that I found on FB Marketplace (we were lucky enough to LOOOOVE living in it even though we never saw it IRL until the contract signing). Fortunately, our ties with the developer had been amicably severed.

The Lessons:

(though some of these I’ve already mentioned in a previous blog post)

- Decide to buy property only if you’ve already computed loan amount + living expenses, and only if your standard of living is not going to take a huge beating. If you cut back too much on the things that make you feel happy, you’re actually doing your mental health a disservice.

- To lessen stress: make sure that you’ve already earned 50% of the total contract price. Then decide if you want to take a loan or not. My husband and I now balk at the thought of taking a loan. We just can’t see ourselves wanting to pay back-breaking interest rates.

- Try before you buy, so that you’ll know if you like being stuck in that environment. The pandemic has been such an eye opener.

- Do not sign a contract for a multimillion purchase without having a lawyer review your contract first.

- Read up about the Maceda Law. Seriously. Before you even consider contacting a real estate agent, read this first.

The Returns:

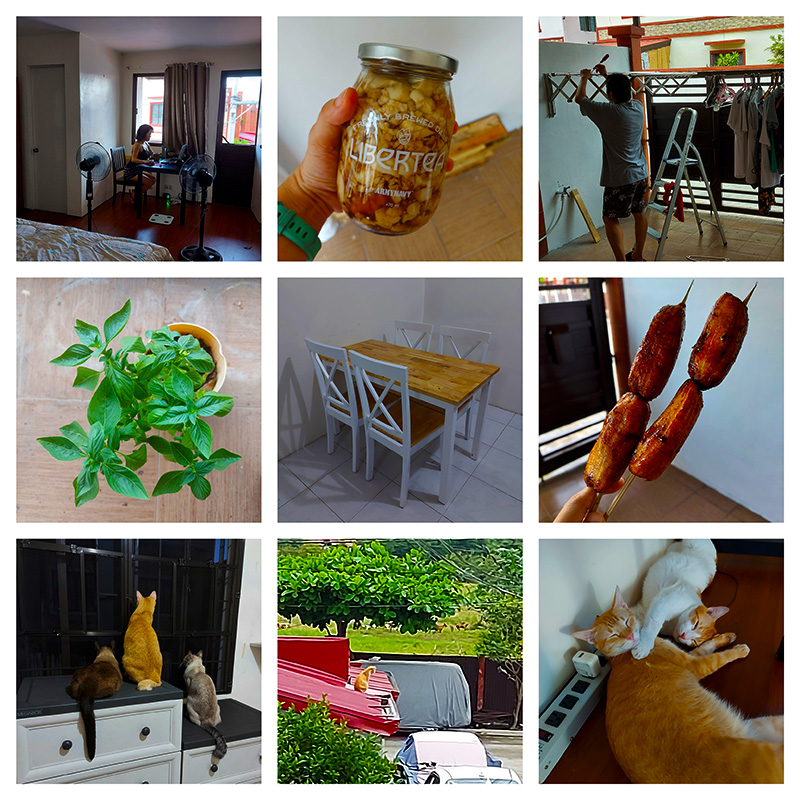

We may not be able to get our money back, but that’s all right. Just a summary of the amazing things that have been happening since we’ve moved:

- It had been difficult to raise plants in the condo, and the only one that actually made it to her 11th month is my revived-from-grocery-cuttings basil plant. Even though she’s a fighter, she used to seem so malnourished. Now, I need to harvest from her every few days because she just keeps sprouting new branches with perfectly healthy leaves.

- Our washing machine no longer complains about being unbalanced. Our condo’s provisions for washing machine was a bit too tight.

- Husband has enough space in the garage for doing wood work. He can also now do maintenance on the car because there’s enough light in the garage.

- Brain breaks for every finished task. We do enjoy our balcony (with the view of goats, bees, and stray cats) very much.

- Our sleep time has matched those of our boomer neighbors’. Wake up before 6AM, shut down laptops by 7PM, in bed by 8PM.

- No one is blasting karaoke in the middle of the night.

- Husband no longer complains about having to use the elevator/stairs repeatedly (we used to be on the 7th floor) whenever deliveries arrive on the same day.

- Both my and my husband’s temperament actually improved. He’s now frequently smiling again, like he’s showing off ’em dimples (he was constantly cranky being stuck in the condo). My work-life balance is just mwaaaah. *chef’s kiss*

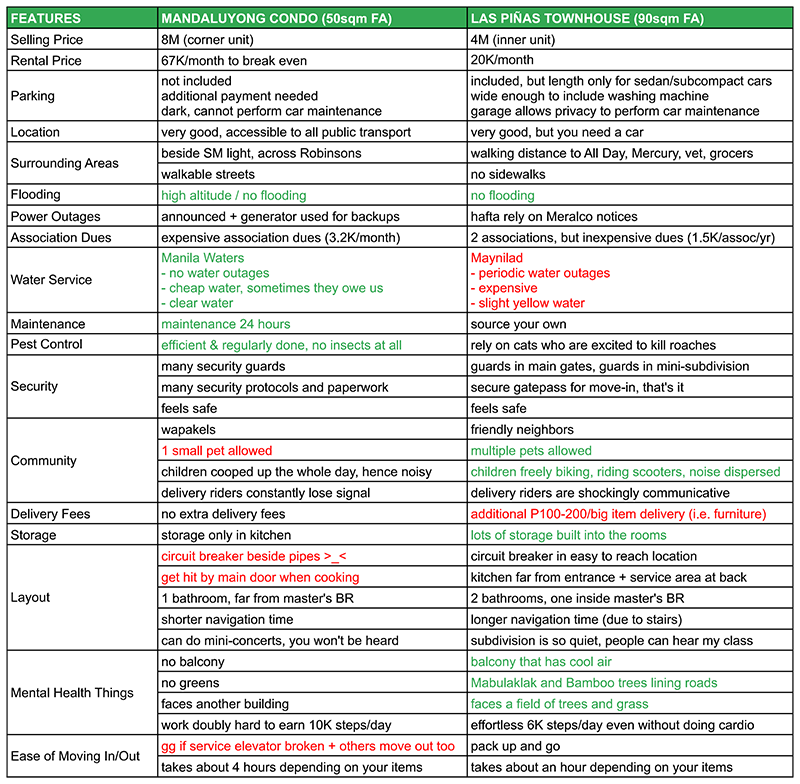

Pros and Cons:

I’ve been doing a pros and cons table ever since we’ve moved here, and so far, I’ve seen a lot of improvements in our standard of living. Noticed that both my husband and I are much happier. We don’t own the place, but it finally feels like home. (At the very least, we have all our cats with us.) I really hope we’ll stay here for a long time before it’s time to buy our retirement home. Still have no plans to take on a loan. Har har har.

Lastly:

It’s ok to not be able to meet the same milestones that your boomer parents did. Really. They lived in a different time. We were almost two decades late in attempting to buy our own property, and that’s totally fine. But there’s a lesson to be learned from their generation: My mom buys properties with cash (EDIT: Mom corrected my simplification of her property-buying habit in the comments, so head in there for the details). My husband and I are taking a page from her book at least. We decided that we’re not going to buy anything unless we could afford to pay for it in cash, including the car we recently purchased for mobility’s sake. Not against people taking loans, of course. You do you. It’s just not for us because we’re the type of people who hate installments. ? (We hated the “kelan ba matatapos to?” feeling, so even for our devices, except for the first couple of experiences in installments, we’ve always paid in full.)

Jean Venturanza Venturanza Lapa

June 27, 2021 at 11:28 amDoc Bee and Jojo! Actually, I didn’t buy property in cash. It was only Cash Simeona property that I bought in cash. My strategy was to buy property on credit while I have extra money. And even without extra money I still buy so we are forced keep our cost of living in the same level. When income increases, people tend to increase wants, and this lifestyle change increases cost. But if you’re amortising an investment, you are forced to live within what’s left. Basic principle: Income – Savings (Investment) = Spend. Actually, before we know it, investments are paid off one after the other – then its time to buy again. Just remember the basic principle: INCOME minus SAVINGS/INVESTMENT =. SPEND.

skysenshi

November 28, 2021 at 11:59 amThanks for the clarification, ma! 😀