Before Buying Property

I was supposed to write about renting first, since many of my students have been asking me how to go about becoming independent. But I’d really like to get this off my chest, because this had been bothering me since the pandemic started. You see, hubby and I bought our first property in September 2019. And with the pandemic now, it is one of the decisions we’ve been regretting.

Not that it was completely an impulse buy. I mean, we had to deal with neighbors whose properties were fire hazards, so I think you guys can understand where we are coming from. Thing is, my parents were against this. The location we chose was prime, and with it came a hefty price tag. My parents owned better properties (basically from higher tiered developers), of course, so they offered to let us rent one of their condos at a fraction of the price their tenants usually pay. I will explain later why this is relevant, and why we should not have insisted on the #strongindependent mindset when it wasn’t practical.

Let’s break down the important factors to consider when you feel like you’re ready to buy property:

- Financial Capability

- Materials and Design

- Lifestyle Compatibility

I’ve only named three, because I’m pretty sure many people have been ooohed and aaahhhed by amenities, which I feel are important, but not as much as these three.

Financial

I only have one advise when it comes to this: STUDY YNAB FOR AT LEAST 6-8 MONTHS before even considering down payment.

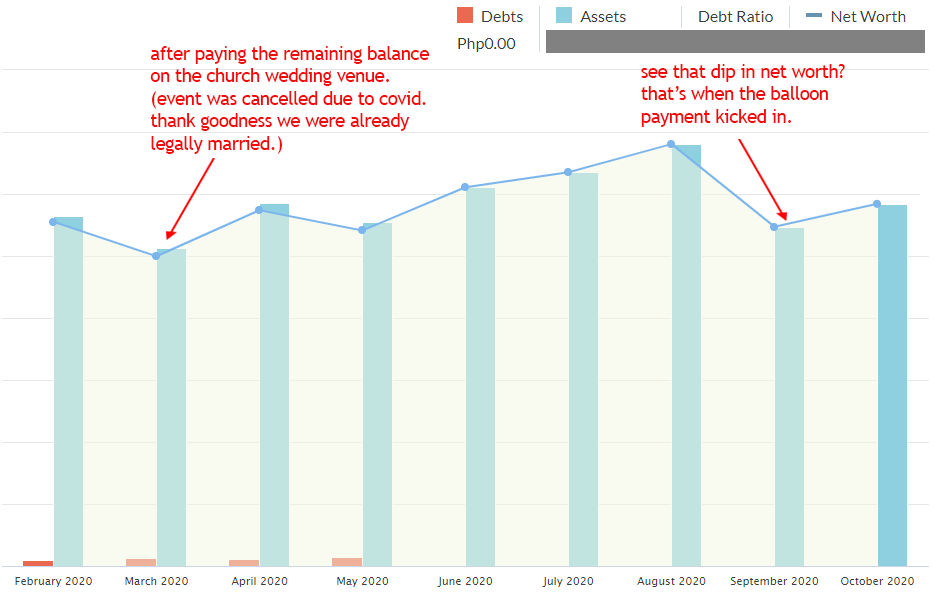

I only got into YNAB four months after we bought the property. On my 8th month of using it, I realized that I had grossly underestimated our earning potential. See, most millennials don’t have the buying power that their parents had when their parents were in their 20s. So it’s kinda easy to fall into the trap of getting into rent-to-own schemes with balloon payments every 12 months. It looks cheap now, but wait till the interest kicks in. You’ll actually be paying waaaaay more than what the property should cost. And you know what’s even more annoying? The pandemic made real estate drop, so with the price we paid for our unit? We could actually now buy TWO slightly smaller 2br units with.

YNAB allowed me to look at our finances in ways that I had never looked at before. It made me see that had we waited 4-5 years, we would have been able to buy property with CASH, WITHOUT INTEREST and without having to deal with balloon payments that do quite a number on your net worth. Think about this for a moment: 4-5 years of waiting versus 20 years paying for interest.

When I analyzed this graph closely, I wanted to kick myself several times. And then I wanted to go back to January 2019 so we can revisit all of the wrong financial decisions we’ve made. Including not getting into YNAB earlier. (I’ve seen suggestions about loan calculators, and while that’s fine, those calculators don’t take into consideration how much your living expenses are. These vary from person to person. You need a budgeting app to first see how much you’re spending versus how much you’re saving, THEN use the loan calculator on top of that.)

Bottom line: Figure out your earning potential first (including the amount you spend on monthly “emergencies”) before making such a huge decision. If I had known earlier that we could actually earn enough money to pay in cash within 4-5 years, we wouldn’t have decided to buy property in 2019. The property did not come with parking space, because that costs another 1M. If we had decided to take up our parents’ offer of renting one of their properties (which came with a parking slot), then we wouldn’t have had to let go of our car. Now we are practically crippled because we do not want to risk getting COVID from taking public transportation.

Another tip: Save at least 50% of the amount you want to spend before taking a leap. Best bet is to look for foreclosed properties and buy those. If you’re looking at pre-owned properties, take note that bank appraisals are usually lower than the selling price (a seller might say his/her property is worth 10M, but the bank will not think so and will only lend you 80% of that), so you need to put buffers.

Materials and Design

It’s the little annoying things that get you. Things to check:

- Is the kitchen stove area located right by the entrance? Imagine that you’re cooking, and your husband opens the door and accidentally knocks you over. Yep. BIG FAT NO. Didn’t realize it until we were using the unit already.

- Do the windows get enough sun? I wasn’t bothered that it didn’t have a balcony because I used to think plants were just unnecessary responsibility. Until the pandemic happened and I started growing a vegetable garden indoors. It wasn’t just the gardening thing. The quarantine forced us to buy a washing machine, and we needed sun for them to dry quickly. That, and you know, you need some daily dose of Vit D.

- Where is the circuit breaker located? OMG. We found out the hard way that our circuit breaker was located near the friggin’ pipes. Its placement was so bad, even the maintenance guys who fixed it complained about the bad design. The good thing about it is that admin and maintenance were so efficient, they were able to locate which floor the leak was coming from and it took less than a day for the problem to get fixed.

- How many outlets are there, and where are they located? Try to imagine where you’ll be working/cooking/studying/relaxing. Also try to calculate the number of items you’ll be plugging in on a daily basis. We have had to implement some of the outlets ourselves. And it’s annoying how very few they were, considering the size of our unit.

- Does it have enough storage space? I’m minimalist, and I try not to keep unnecessary things. But even I thought it was ridiculous how we can’t even imagine where to place cabinets and drawers. Bad enough that there wasn’t enough storage, the layout was just whack. Seems like you need to pay more to have custom-fitted cabinets and drawers.

- Would you mind spending quarantine in it? We used to have a nice view of Makati in our previous condo, and you can even see some mountains on a clear day. In this current condo, all you can see from the windows are just unfinished construction, unfinished pool, and the facade of the buildings opposite ours. Who wants to look at that?

- If condo, which tower are you looking at? I learned that the first two towers will usually be the best ones because they’re the model buildings. We decided to buy from this compound because I was renting from Tower 2 for 3 years, got married on my second year of living in it. Husband and I love this compound, but we had to move out because the unit became too small after we moved in together. The unit we bought is from one of the newer towers, and only upon moving in did we realize that the materials were substandard compared to Tower 2’s. Ironically, this unit is probably 4x the price of our Tower 2 home (basing this on how much rent I used to pay). Tower 2 layout was also tons better, even though it was smaller.

Lifestyle Compatibility

Location is already a given when people look for permanent homes. I do not see the point of buying property in an area that’s more than 20km away from your work place. Of course, this has become moot with the quarantine and all. You could be located in Baguio and still remotely report to work in Manila-based office. So let’s consider lifestyle:

- Do you have pets or plan to have pets? How many? Before we had cats, one of the things I asked our Tower 2 landlady was if she allowed pets. Luckily, she’s a dog lover and said yes. So when we were finally looking at properties to buy, this was the first compound that came to mind. Unfortunately, the admin/association rules changed and we had to return one of our cats to my parents. We only found out about the rule change AFTER we had already given our down payment. So please please please check this thoroughly. Agents don’t have power over admin, by the way. Rules change without the agents’ knowledge. I’ve heard about a horror story of a big dog owner who found out that her building only allowed toy dogs AFTER she had bought the unit.

- What kind of pets do you have? If you have big dogs, maybe a house would be a better choice. My husband wanted a house, but I’ve heard enough stories of cats escaping houses and getting run over (or killed by evil neighbors), so I didn’t want a house.

- Do you have children or plan to have children? Space and amenities are huge factors when choosing a home. Children need tons of space to run around in. So if you choose to buy a condo, make sure that not only is it big enough, it must have amenities (playground, pool, etc.) for children.

- Do you have a car or intend to own one? LOL, we let go of our car because we were in a prime location where we can walk to just about everywhere. And it’s also accessible to all forms of public transportation. But now that the pandemic hit, we realized that we should have factored in parking space because taking public transportation poses such a high risk. We can’t walk to our doctors, so we’re basically self medicating until we can find doctors who are within walking distance.

- Do you cook? Before the pandemic, I didn’t. At least not regularly. So I didn’t think much about the kitchen’s layout. Boy, was I wrong. Now, both husband and I cook, so I had to turn a portion of the living room into an extension of the kitchen.

- Do you see yourself gardening? I CANNOT STRESS THIS ENOUGH: Sun, sun, sun.

- How obsessed are you with security? I like the idea of CCTVs, and layers upon layers of security protocols before people can reach us. We don’t want uninvited guests, unwanted solicitations during Christmas seasons, carolers who can’t be bothered to hit the right notes, possibly akyat-bahay gangs etc. etc. That’s why I wanted to live in a condo compound. Hubby gets annoyed with the security passes he has to obtain to get furniture in and out of the condo, but I find that’s a small price to pay for the security. I’m willing to live in a house as long as it’s a townhouse within an enclosed compound as well.

So far these are all the things I can think of as I wallow in regret. Sure, we have a condo, but we’re being super stingy with ourselves (can’t enjoy our own money) because we’ve been saving up for medical emergencies. We also can’t buy a new car, all of our money are going to balloon payments. Plus, we’d need to buy parking, too.

I wrote this in the hopes that our wrong decision may be able to help other people in the future. ?

Jean

October 31, 2020 at 8:46 amUse the parking in Pioneer Highlands.

Zerah

January 9, 2021 at 9:11 amThanks Doc Bea. As always.

skysenshi

January 9, 2021 at 9:36 amNo problem! 🙂 Hope it helps. 🙂